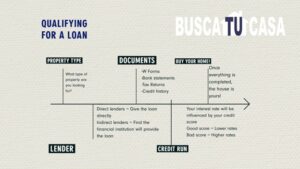

Buying a home for the first time can sometimes be a scary experience. You go online, you search for the home that fits your needs. Maybe you found the right one, maybe that’s the place where you will raise a family…hold on, how much is it?!! Ah yes, you will need to get a loan to pay off that house. However, you may have no idea where to start. You are probably wondering, what if I have a bad credit score? How can I choose the right lender? Well, today we will walk you through how to qualify for a loan.

Property type lender

First things first, the lender. This is the person that will be giving you the loan, so it is important to choose wisely. There are two types of lenders: direct and indirect. Direct lenders are the ones who will give you the loan directly, while indirect lenders are the ones who will find another lender to finance your loan. It is important to shop around and compare rates before deciding on a lender. However, it is more than likely the real estate company you will work with already has a lender or will refer you to one.

Get Your Documents Together

The second thing you need to do is get your documents in order. The lender will need to see your identification, your W-two forms from the past two years, bank statements, and tax returns. They will check your Debt to income. Your debt-to-income ratio is composed of your total monthly debts divided by your gross monthly income. Lenders like to see a debt-to-income ratio of less than 36%, with no more than 28% of that debt going towards servicing your mortgage. If you are self-employed, you will also need to provide profit and loss statements from the past two years. Once the lender has all of your documentation, they will order a credit report.

Credit Run

Your credit score is very important when qualifying for a loan. A high credit score means you’re a low-risk borrower, which could lead to a lower interest rate on your loan. A lower credit score could lead to a higher interest rate and could mean you will more than likely have to pay more, unfortunately.

After your credit run is completed, the lender will give you a call to tell you what interest rate they can offer you and what your monthly payments could look like.

Finally…

If everything looks good, the next thing the lender will do is an appraisal, which is essentially an evaluation of the value of the property you are looking to purchase. The appraiser will come out to make sure that the home is worth what you are asking for it.